Find trends before others: Frameworks, Techniques, Sources and Prompts

Discover the complete operating system for spotting revenue opportunities 6-12 months before competitors. This framework transforms reactive trend-following into demand anticipation.

This post is long for an email… Here is a link to complete article.

“Vibe coding” went from Andrej Karpathy’s tweet to Collins Dictionary “Word of the Year” in five months.

RAG went from 10 academic papers in 2022 to 1,202 papers in 2024—a 120x explosion.

AI adoption doubled from 33% to 71% in enterprise usage in a single year.

The window between “early signal” and “everyone knows” is compressing violently.

And most GTM teams are still running downstream playbooks—reacting to trends instead of anticipating them.

This piece gives you the operating system to change that.

What’s Inside

The Mental Model: Ideas Flow Like a River

Phase 1: Signal Mining (with Prompts)

Phase 2: Demand Validation (with Prompts)

Phase 3: Monetization (with Prompts)

The Trend Prioritization Scorecard

Mini Case Examples

The Monday-Morning Checklist

The Complete Tool Stack

The Mental Model: Ideas Flow Like a River

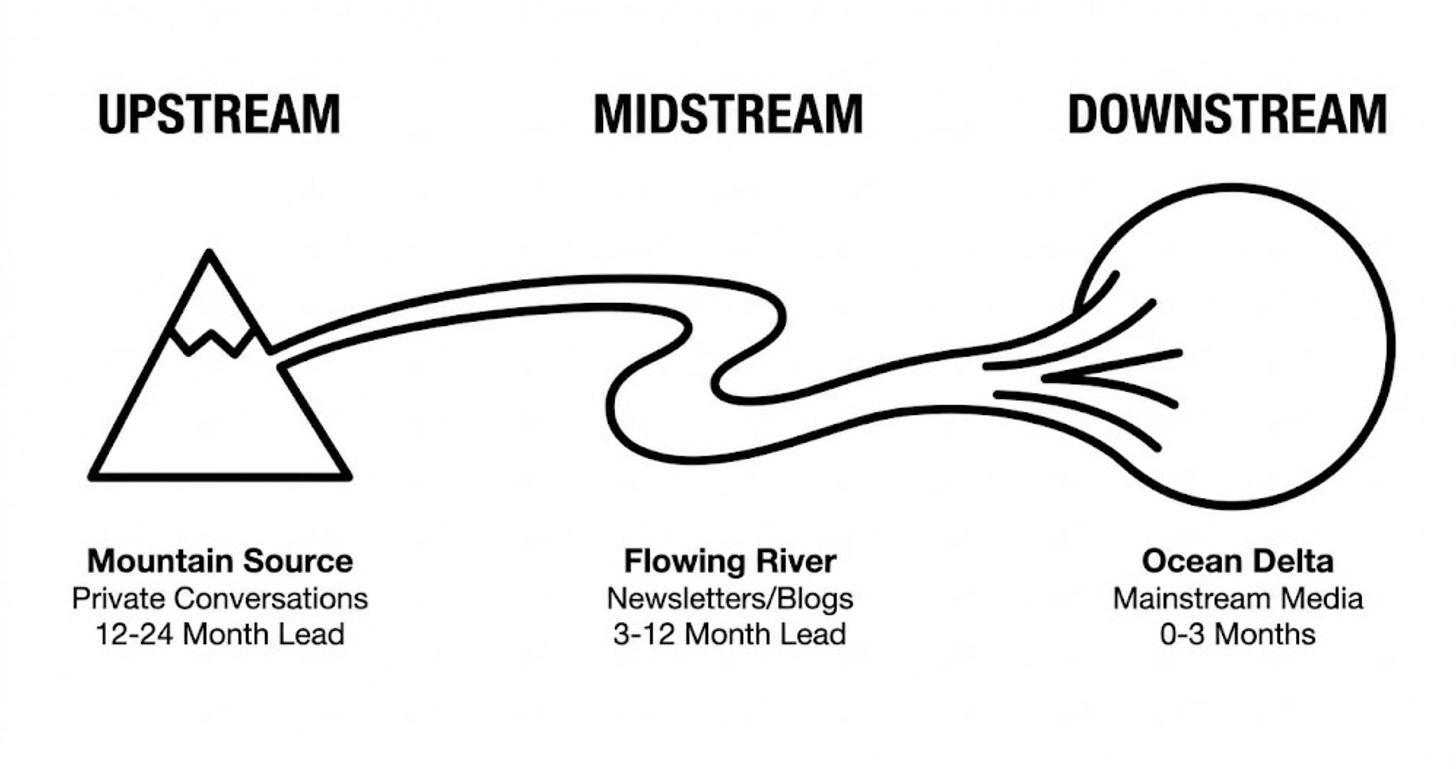

Information doesn’t spread evenly. It moves in predictable layers:

Upstream: Private Slack channels. Niche Discord servers. Early practitioner conversations. The place where someone says “I’ve been doing this thing...” before it has a name.

Midstream: Investor theses. Newsletters like Lenny’s or Growth Unhinged or StartupGTM. Blog posts from operators. The place where patterns get named and frameworks emerge.

Downstream: TechCrunch headlines. LinkedIn virality. Conference keynotes. The place where everyone already knows.

Here’s what this means for GTM:

Upstream = Signal Advantage = 12-24 months time lead

Midstream = Validation Advantage = 3-12 months time lead

Downstream = Distribution Advantage = 0-3 months time lead

Most teams operate downstream. They see a trend on TechCrunch and scramble to create content.

By then, competition is saturated and CAC is inflated.

The play is to spot upstream, validate midstream, and monetize before downstream.

The Trend-Spotting OS

This isn’t a list of tools. It’s a three-phase system: Signal → Validation → Monetization.

PHASE 1: SIGNAL MINING

You’re looking for patterns before they have names. Here’s where to find them:

Niche Communities

Reddit organic traffic grew 374% between October 2023 and 2024. Subreddits now appear directly in Google SERPs.

But the real value isn’t traffic… it’s unfiltered buyer language.

The sweet spot: subreddits with 10K-100K members growing at 0.3%+ daily. Large enough to indicate real demand. Small enough to be pre-mainstream.

Your Reddit Intelligence Stack

Reddit Pro — Free (beta) The official solution. Tracks 100K+ keywords with AI trend insights, conversation volume visualization, and publishing tools. The Trends tab reveals where and when keywords appear in real-time.

SubredditStats — Free Keyword frequency trends over time plus network visualizations showing user overlap between communities—revealing adjacent market opportunities.

Syften — $19.95/month Real-time keyword alerts with 1-minute delay across Reddit, HN, Twitter, and GitHub. Set it and get notified instantly.

Pro tip: Set filters for problem keywords—”looking for,” “alternative to,” “struggling with,” “any recommendations”—to catch demand signals before they become searchable trends.

The Signal Mining Megaprompt:

You are a Community Intelligence Analyst. Analyze the top 50 posts from [SUBREDDIT] over the past 30 days.

For each post, extract:

1. The core pain point or frustration expressed

2. Any workarounds or DIY solutions mentioned

3. Products praised or criticized (with specific quotes)

4. Questions that remain unanswered

Then synthesize:

- Top 5 recurring pain points ranked by frequency and engagement

- Products with highest criticism-to-praise ratio (opportunity signals)

- Language patterns: exact phrases users repeat when describing their problem

- Gaps: problems with no mentioned solution

Output as a structured brief I can share with product and marketing.The Reddit Competitive Analysis Prompt:

Analyze Reddit discussions about [COMPETITOR] across relevant subreddits.

Extract:

1. PRAISE PATTERNS: What do users consistently love? (features, support, pricing)

2. COMPLAINT CLUSTERS: Recurring frustrations grouped by theme

3. SWITCHING TRIGGERS: What makes users consider alternatives?

4. FEATURE REQUESTS: What’s missing that users explicitly want?

5. COMPETITOR MENTIONS: Which alternatives do users recommend instead?

For each finding, include 2-3 exact quotes as evidence.

Output: Competitive intelligence brief with actionable positioning opportunities.Expert Interviews

Communities show you what people say publicly. Interviews reveal what they believe privately.

The best sources: operators 2-3 years ahead of your ICP. They’ve already hit the problems your buyers will face.

The Expert Extraction Prompt:

I’m interviewing [EXPERT ROLE] about [TOPIC]. Generate 10 questions designed to surface:

- Workflow friction they’ve personally experienced

- Tools they’ve abandoned and why

- Predictions they have that aren’t yet mainstream

- What they wish existed but doesn’t

- How their buying criteria have changed in the past 12 months

Avoid generic questions. Focus on extracting specific, actionable intelligence.The Interview Synthesis Prompt:

I’ve completed [NUMBER] expert interviews on [TOPIC]. Here are my notes: [PASTE NOTES]

Synthesize into:

1. CONSENSUS VIEWS: What do 70%+ of experts agree on?

2. CONTRARIAN INSIGHTS: What did 1-2 experts say that contradicts conventional wisdom?

3. EMERGING PATTERNS: Problems mentioned by multiple experts that aren’t yet mainstream

4. PREDICTION CLUSTERS: Where do experts think this space is heading in 12-24 months?

5. VOCABULARY MAP: Specific terms/phrases experts use that differ from marketing language

Flag any insights that could inform product roadmap, positioning, or content strategy.Financial & Regulatory Filings

This is where most GTM teams never look… which is exactly why you should.

SEC 10-K filings contain a “Risk Factors” section where companies are legally required to disclose threats. These are often the first public mention of emerging competitive dynamics.

The Federal Reserve Beige Book (published 8x/year) contains qualitative data on emerging economic patterns before they hit official indicators.

Your Financial Intelligence Stack

SEC EDGAR — Free Full-text search across 20+ years of 10-K, 10-Q, and 8-K filings. Search competitor filings for mentions of emerging technologies, market risks, and strategic pivots.

Federal Reserve Beige Book — Free Published 8 times annually with qualitative insights on regional economic conditions from business contacts—often revealing trends before they appear in quantitative data.

FRED — Free Maintains 800,000+ economic time series with free API access for tracking macroeconomic indicators affecting target markets.

Seeking Alpha Transcripts — Free Same-day earnings call transcripts for 4,500+ companies. Mine these for forward-looking statements and strategic signals.

The SEC Filing Analysis Prompt:

Analyze the Risk Factors and MD&A sections from [COMPANY]’s most recent 10-K filing.

Identify:

1. Novel risks mentioned for the first time (not in prior year’s filing)

2. Competitive threats specifically named

3. Technology shifts the company is responding to

4. Regulatory changes affecting operations

5. Market segments described as “declining” or “challenging”

For each finding, note the exact quote and explain the GTM implication—what opportunity or threat does this signal?The Earnings Call Intelligence Prompt:

Analyze the last 4 earnings call transcripts from [COMPANY].

Extract:

1. STRATEGIC PIVOTS: New initiatives or focus areas mentioned

2. COMPETITIVE POSITIONING: How they describe their differentiation

3. MARKET SIGNALS: Customer segments they’re prioritizing or deprioritizing

4. TECHNOLOGY INVESTMENTS: Where they’re allocating R&D spend

5. PAIN POINTS: Challenges they’re actively solving for customers

6. FORWARD GUIDANCE: Predictions about market direction

Compare quarter-over-quarter to identify shifts in narrative or strategy.Investor Newsletters

VCs are paid to predict category shifts. Their public writing is essentially free trend research.

Don’t just read them. Systematically extract their predictions.

Your VC Intelligence Stack

Free Tier:

a16z Newsletters — Free Sector-specific newsletters including Enterprise/B2B covering AI, data, security, and SaaS.

Bessemer Atlas — Free Investment roadmaps and the definitive annual State of the Cloud report. Their published memos reveal early-stage thesis thinking.

First Round Review — Free Tactical playbooks from founders at Figma, Mercury, and Stripe. Operator ground truth, not investor perspectives.

NFX Essays — Free 422+ pieces on network effects (responsible for 70% of tech value since 1994), growth, and fundraising. The Network Effects Bible is foundational.

CB Insights Newsletter — Free Data-driven trend analysis. Their annual Tech Trends report identifies emerging categories.

Not Boring — Free Packy McCormick’s business strategy newsletter. 255K+ subscribers.

Growth Unhinged — Free/Premium Kyle Poyar on PLG, pricing, and AI monetization. 80K+ subscribers.

And my “StartupGTM Newsletter” as well :)

Premium Tier:

The Diff — $20/month Byrne Hobart’s contrarian financial/strategic analysis. 50K+ professional subscribers. Worth every penny.

Stratechery — $12/month Ben Thompson’s Aggregation Theory. Shapes how Silicon Valley thinks about platform economics.

Lenny’s Newsletter — $15/month The #1 product/growth newsletter. Includes access to 30K+ member Slack community.

The Newsletter Synthesis Prompt:

I will paste the last 4 issues of [NEWSLETTER]. Analyze for:

1. Themes mentioned in 3+ issues (these are conviction bets)

2. Specific companies highlighted as exemplars

3. Metrics or benchmarks cited as “good” or “best-in-class”

4. Explicit predictions about market direction

5. Criticism of current practices (these signal what’s changing)

Rank themes by emphasis. Flag anything that contradicts conventional wisdom.The VC Thesis Extraction Prompt:

Analyze [VC FIRM]’s recent blog posts, investment announcements, and partner tweets.

Identify:

1. CATEGORY BETS: Where are they concentrating investments?

2. THESIS EVOLUTION: How has their thinking shifted in the past 12 months?

3. EXEMPLAR COMPANIES: Who do they cite as category leaders?

4. ANTI-PORTFOLIO SIGNALS: Categories they’re explicitly avoiding (and why)

5. TIMING INDICATORS: What macro conditions do they believe favor their thesis?

Output as a thesis map I can use to predict where capital and attention will flow.Funding & Startup Intelligence

Track where capital is flowing before categories get crowded.

Crunchbase — Free / Pro $49/month 96M+ company profiles with Scout AI for automated prospecting based on funding patterns.

Harmonic.ai — Custom pricing Publishes quarterly Hot 25 rankings of top startups based on aggregated VC interest. Tracks earliest-stage companies before other providers.

Dealroom — Freemium Excels at European startup ecosystem coverage.

The Funding Pattern Analysis Prompt:

Analyze recent funding announcements in [CATEGORY] over the past 6 months.

Identify:

1. DEAL VELOCITY: Is funding accelerating or decelerating?

2. STAGE DISTRIBUTION: Are deals concentrated in seed, Series A, or growth?

3. INVESTOR OVERLAP: Which VCs are making multiple bets in this space?

4. POSITIONING PATTERNS: How are funded companies describing themselves?

5. VALUATION SIGNALS: What multiples are being paid (if disclosed)?

6. GEOGRAPHIC CLUSTERS: Where are these companies based?

Flag any patterns that suggest the category is heating up or cooling down.PHASE 2: DEMAND VALIDATION

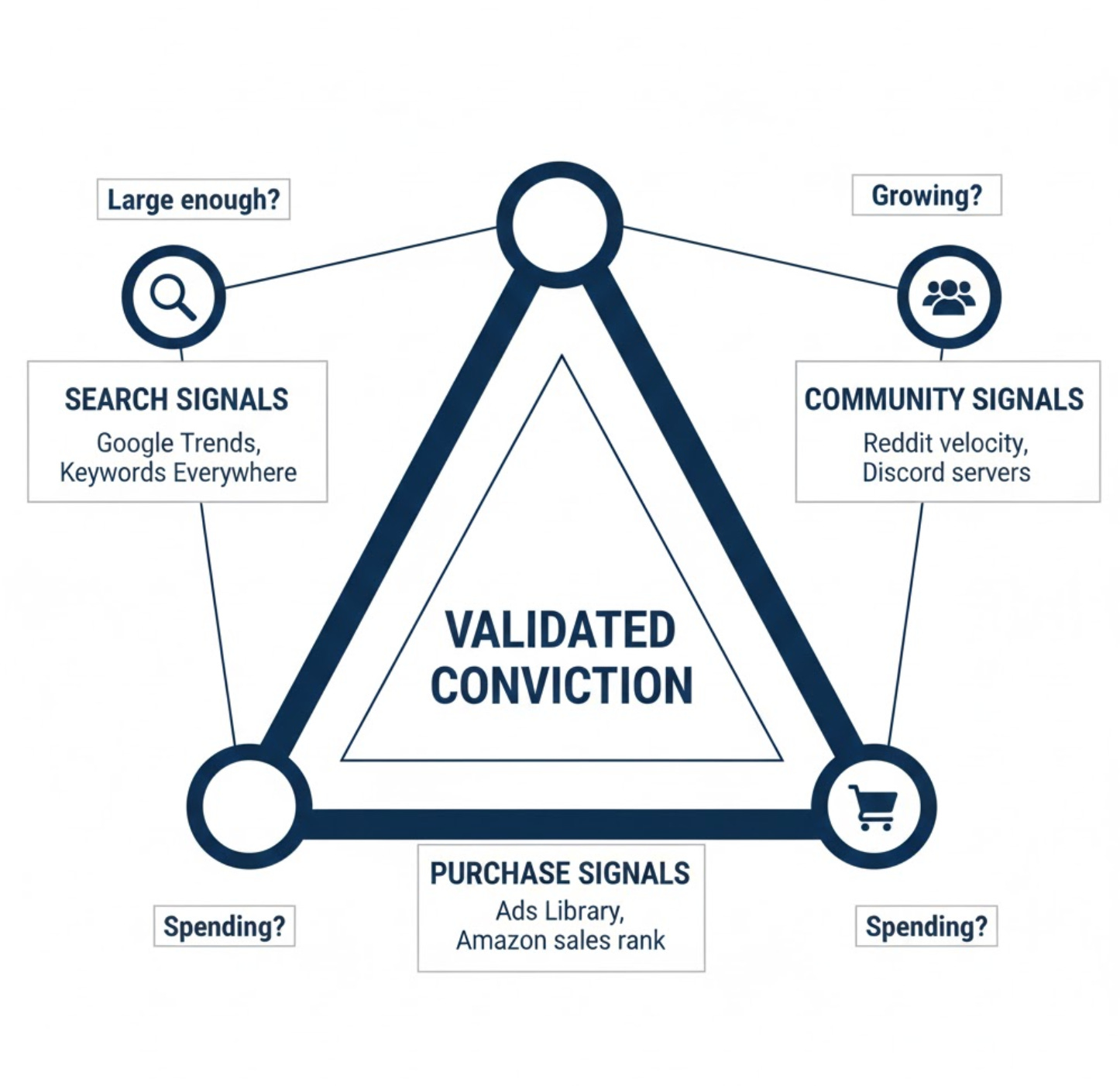

Signals are hypotheses. Validation turns them into conviction.

You’re answering three questions:

Is the problem large enough?

Is interest growing or declining?

Are people already spending money to solve it?

Search Demand Signals

Keywords Everywhere shows search volume directly in your browser. SimilarWeb shows traffic patterns and competitor data. Google Keyword Planner shows historical trends.

The pattern you want: sustained 6+ month growth, not a spike-and-crash.

Your Search Intelligence Stack

Google Trends — Free The baseline for search interest trajectory. Use category filtering and region comparison for deeper analysis.

Pytrends API — Free Python library for automated Google Trends data extraction. Build dashboards that track your keywords automatically.

Keywords Everywhere — $15-200/year Shows search volume directly in Google, YouTube, and Amazon as you browse. Essential browser extension.

Glimpse — Free / ~$250/month Transforms Google Trends from relative to absolute data. Shows actual search volumes, YoY growth, and channel breakdown. Claims 95%+ backtested accuracy on forecasting.

Exploding Topics — $39-249/month Identifies emerging topics 12-24 months before mainstream awareness. Database of 779,000+ trends. Now owned by Semrush.

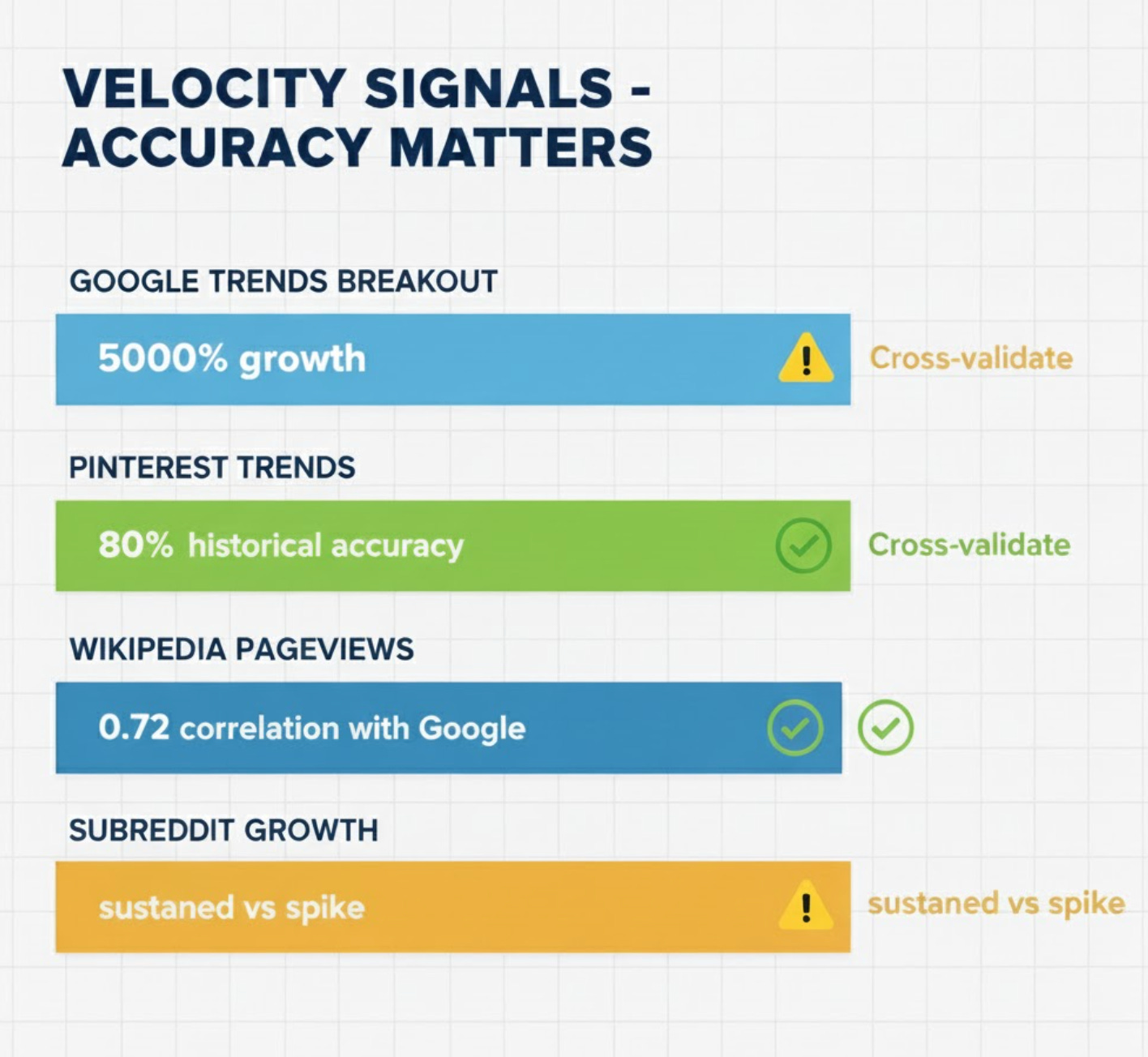

Trend Velocity Signals

Google Trends “Breakout” means 5,000%+ growth. But breakouts can be noise.

Cross-validate with:

Pinterest Trends — Free 80%+ historical accuracy on their annual Pinterest Predicts report. Valuable for consumer-facing B2B in retail, CPG, and lifestyle verticals.

Wikipedia Pageviews — Free Shows 0.72+ correlation with Google search frequency. An overlooked signal for measuring public awareness of technologies, companies, and concepts. Data available from July 2015.

Subreddit growth velocity — Check via FrontPage Metrics Sustained growth beats viral spikes. Look for consistent 0.3%+ daily growth over weeks, not one-day explosions.

The Demand Validation Megaprompt:

You are a Demand Validation Analyst. I’m evaluating [TREND/TOPIC] as a potential GTM opportunity.

Research and compile:

SEARCH SIGNALS:

- Estimated monthly search volume for primary keywords

- 12-month trend direction (growing/stable/declining)

- Related keywords with rising interest

COMMUNITY SIGNALS:

- Relevant subreddits and their growth rates

- Discord servers dedicated to this topic

- Slack communities or forums

PURCHASE SIGNALS:

- Companies actively advertising solutions (check Facebook Ads Library, TikTok Creative Center)

- Products on Amazon addressing this need (sales rank, review velocity)

- Venture funding into this category (recent rounds)

COMPETITIVE SIGNALS:

- Existing solutions and their positioning

- Gaps in current offerings (from review analysis)

- Pricing models in use

Output a validation score (1-10) with supporting evidence for each dimension.The Market Sizing Prompt:

Calculate market size for [PRODUCT/CATEGORY]:

- What it does: [describe main value]

- Target customer: [who buys it]

- Price point: $[amount] per [month/year]

Provide:

1. TAM with calculation steps and data sources

2. SAM with realistic filters (geographic, regulatory, technical)

3. SOM for years 1, 3, and 5

4. Key assumptions requiring validation

5. Comparable markets/products for benchmarking

Flag any data gaps that would change the estimate significantly.Purchase Signal Validation

The ultimate validation: people are already paying.

Your Ad Intelligence Stack

Meta Ad Library — Free Shows all active ads on Facebook, Instagram, and Messenger. EU transparency data includes reach, targeting demographics, and impression data. Ads running 2+ weeks likely perform well.

TikTok Creative Center — Free Displays top-performing ads by industry with CTR data by second. The Top Ads Dashboard and Keyword Insights reveal trending ad copy and messaging patterns.

Google Ads Transparency Center — Free Covers Search, Display, and YouTube ads from verified advertisers.

LinkedIn Ad Library — Free Launched June 2023. Essential for B2B competitive intelligence. EU ads show targeting demographics. Search by company to see all active campaigns.

BigSpy — From $9/month Covers 10 platforms with 1B+ creatives across 71 countries. Good for multi-platform competitive research.

Key validation signals:

Ads running 30+ days = likely profitable

Jungle Scout ($29/month) = 84% accuracy on Amazon sales estimates

Job postings for a function = budget allocation signal

The Ad Library Analysis Prompt:

I’ve collected screenshots/data from [COMPETITOR]’s ads in Meta Ad Library and LinkedIn Ad Library.

Analyze:

1. MESSAGING THEMES: What pain points do they lead with?

2. VALUE PROPOSITIONS: How do they describe their differentiation?

3. PROOF POINTS: What social proof or data do they cite?

4. CREATIVE PATTERNS: What formats perform best (video, carousel, static)?

5. CTA PATTERNS: What action do they drive toward?

6. AUDIENCE SIGNALS: Who are they targeting (from EU transparency data)?

Compare to our current messaging and identify gaps or opportunities.Job Posting Signals

Hiring patterns are leading indicators for market direction.

Revelio Labs — Enterprise pricing Creates the “first universal HR database” with 4.1 billion+ job postings from 6.6 million companies. Tracks headcounts, hiring rates, skills demand, and salary trends.

Indeed Hiring Lab — Free Publishes the Job Postings Index (JPI) as a real-time employer demand measure. Data also available on FRED.

LinkedIn Economic Graph — Enterprise Tracks hiring rates and skills trends from 1B+ professionals.

The Job Posting Signal Prompt:

Analyze job postings for [ROLE/FUNCTION] at companies in [INDUSTRY] over the past 6 months.

Identify:

1. VOLUME TRENDS: Are postings increasing or decreasing?

2. SENIORITY DISTRIBUTION: Entry-level vs. senior hires (indicates maturity)

3. SKILL REQUIREMENTS: What tools/technologies are mentioned most?

4. SALARY SIGNALS: What compensation ranges are offered?

5. COMPANY PATTERNS: Are startups or enterprises hiring more?

6. GEOGRAPHIC CLUSTERS: Where are these roles concentrated?

Flag any patterns that indicate emerging or declining demand for this function.PHASE 3: MONETIZATION

This is where most trend-spotting content stops.

But identifying a trend without monetizing it is just intellectual entertainment.

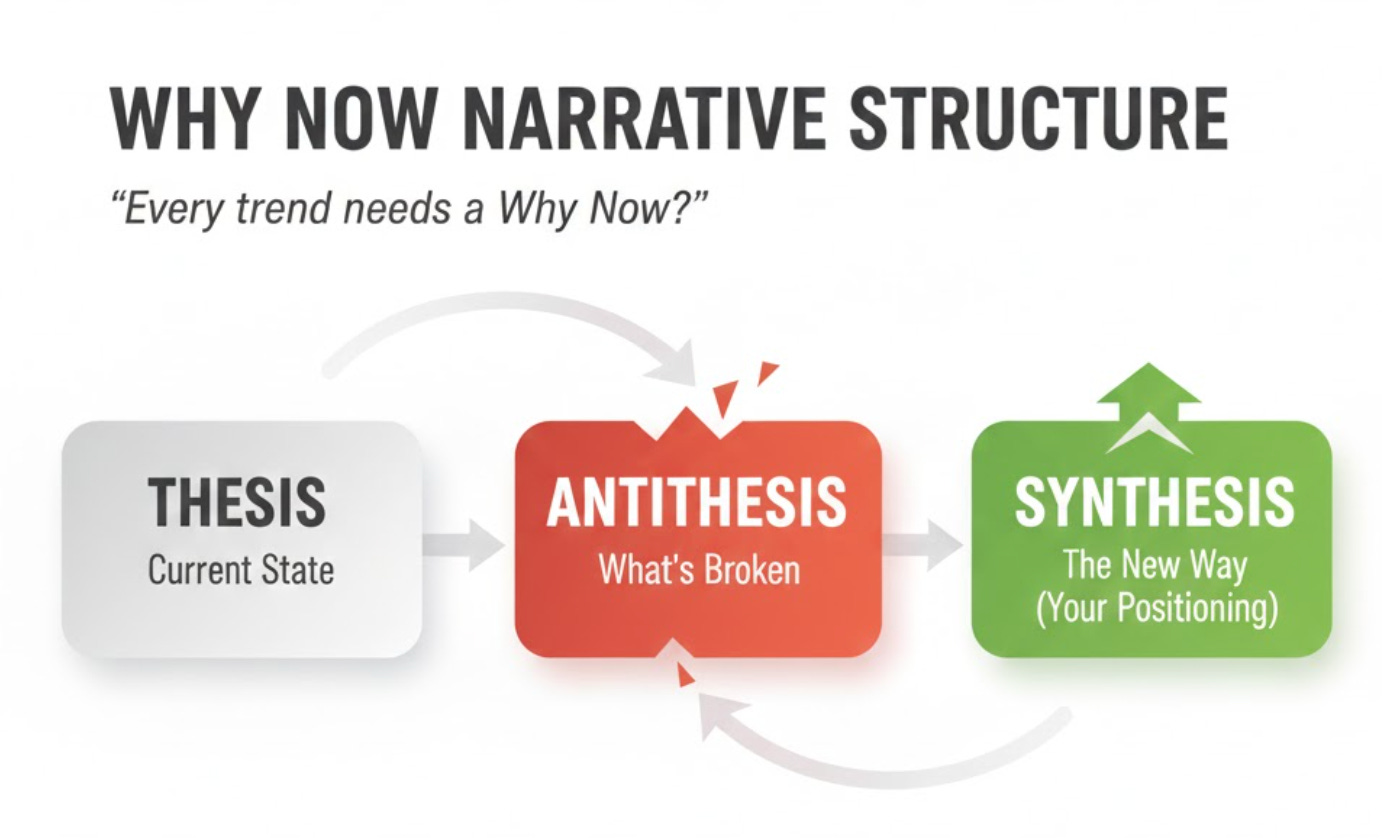

Narrative Development

Every trend needs a “Why Now?” Turn your signal into a wedge narrative.

Structure:

Thesis: Here’s the current state

Antithesis: Here’s what’s broken

Synthesis: Here’s the new way (your positioning)

The Narrative Builder Prompt:

I’ve identified [TREND] as an emerging opportunity. Help me develop a “Why Now?” narrative.

Based on this trend data: [INSERT VALIDATION DATA]

Generate:

1. A one-sentence “Why Now?” hook

2. Three supporting proof points (data, examples, or shifts)

3. The “old way vs. new way” contrast

4. A specific, contrarian claim I can own

5. The ideal customer who feels this pain most acutely

Write in a tone that’s confident but not hypey. Operator-grade.The Contrarian Positioning Prompt:

Analyze the dominant narratives in [CATEGORY] based on competitor messaging, analyst reports, and industry coverage.

Identify:

1. CONSENSUS VIEWS: What does everyone in the space believe/say?

2. HIDDEN ASSUMPTIONS: What’s accepted but rarely questioned?

3. EMERGING COUNTER-EVIDENCE: Data or trends that contradict the consensus

4. CONTRARIAN ANGLES: 3-5 positions we could take that differ from mainstream

5. RISK ASSESSMENT: Which contrarian angles are defensible vs. reckless?

For each contrarian angle, provide the argument structure and supporting evidence needed.Free Tools as Lead Magnets

Free tools are obliterating eBooks.

Palisade Fence Company traces 45% of their 2024 revenue to a single cost calculator.

The play: find a low-difficulty keyword (KD 0-5) with 1,000+ monthly searches. Build a free tool that solves one specific problem. Gate the full results.

The Free Tool Ideation Prompt:

I’m in the [INDUSTRY] space targeting [ICP]. Based on these validated pain points: [INSERT PAIN POINTS]

Generate 10 free tool concepts that:

1. Solve one specific, contained problem

2. Can be built in under 2 weeks

3. Naturally lead to our paid offering

4. Target keywords with <20 difficulty and 500+ monthly volume

5. Deliver immediate, personalized value

For each concept, include: name, one-sentence description, primary keyword target, and conversion hook to paid product.The Calculator/Tool Spec Prompt:

I want to build a [TYPE] calculator/tool for [ICP] targeting the keyword [KEYWORD].

Design:

1. INPUT FIELDS: What data does the user provide? (keep minimal for completion)

2. CALCULATION LOGIC: What formula or methodology produces the output?

3. OUTPUT FORMAT: How should results be displayed for maximum value?

4. GATE STRATEGY: What’s shown free vs. behind email capture?

5. UPSELL HOOK: How does this naturally connect to our paid offering?

6. VIRAL MECHANICS: What makes users want to share their results?

Include copy for the page headline, subhead, and CTA button.ICP Discovery from Trends

The ICP Crystallization Prompt:

Based on [TREND/SIGNAL] we’ve identified, define the Ideal Customer Profile who feels this pain most acutely.

Structure as:

FIRMOGRAPHICS:

- Company size (employees, revenue)

- Industry/vertical

- Geographic focus

- Tech stack indicators

SITUATION TRIGGERS:

- What event makes them actively seek a solution?

- What’s broken in their current approach?

- What have they tried that failed?

BUYING SIGNALS:

- Job titles involved in purchase

- Budget indicators

- Competitive tools they’re currently using

- Content they consume

ANTI-PATTERNS:

- Who looks like ICP but isn’t a good fit?

- What disqualifies a prospect?

Output as a one-page ICP document I can share with sales and marketingContent Strategy from Trend Signals

The Content Calendar Prompt:

Based on [EMERGING TREND] and our positioning as [YOUR POSITIONING], generate a 90-day content strategy.

For each piece, include:

1. TITLE: Compelling headline

2. FORMAT: Blog post, guide, tool, video, podcast episode

3. KEYWORD TARGET: Primary keyword and search volume estimate

4. ANGLE: How this connects to the trend and our POV

5. FUNNEL STAGE: Awareness, consideration, or decision

6. CTA: What action should readers take?

Prioritize by:

- Keyword difficulty (easier first)

- Trend timing (capitalize on rising interest)

- Competitive gap (what’s missing from current contentThe Trend Prioritization Scorecard

Not all signals deserve action. Score each opportunity:

Urgency — How fast is this accelerating? (1-5)

Budget Signal — Are people already spending? (1-5)

Competitive Noise — How crowded is the space? (1-5)

Distribution Readiness — Can we reach the audience fast? (1-5)

Speed-to-Prototype — How quickly can we build something? (1-5)

Monetization Clarity — Is the revenue path obvious? (1-5)

Scoring Guide:

25-30: Act immediately

18-24: Queue for next quarter

12-17: Monitor monthly

Below 12: Deprioritize

Mini Case Examples

Bessemer’s Cloud Prediction

In 2016, Bessemer predicted the public cloud market would hit $500B by 2020.

It hit that mark in March 2018—two years early. By 2021, it peaked at $2.7T.

The lesson: investor theses, when backed by rigorous analysis, are leading indicators. Founders who aligned early captured asymmetric value.

Access their current thinking at bvp.com/atlas.

Feedly’s Acqui-Death Capture

When Google announced Reader’s shutdown in March 2013, Feedly gained 500,000 users in 48 hours.

By July: 15 million users.

By August: $500K raised overnight from lifetime account sales.

They’d anticipated the shutdown and built migration infrastructure in advance.

When large platforms abandon users, there’s immediate demand for alternatives.

The Monday-Morning Checklist

Weekly (30 min):

[ ] Scan 2-3 investor newsletters for emerging themes

[ ] Quick Google Trends check on 5 keywords you’re tracking

[ ] Review Meta Ad Library and LinkedIn Ad Library for new advertisers

Monthly (2 hours):

[ ] Read latest Beige Book summary

[ ] Review SEC Risk Factors for 2-3 public competitors on EDGAR

[ ] Update trend prioritization scorecard

[ ] Conduct 2-3 structured expert interviews

Quarterly:

[ ] Deep-dive competitor pitch decks (Google: “[industry]” AND “pitch deck” filetype:pdf)

[ ] Analyze 10-K MD&A sections

[ ] Refresh “Why Now?” narrative based on new signals

[ ] Review Crunchbase for funding pattern changes

The Complete Tool Stack

Free Starter Stack (~$0/month)

Signal Mining:

Reddit Pro — Official Reddit analytics (free beta)

reddStats — Weekly growth newsletter

Search & Trend Validation:

Google Trends — Search interest baseline

Pinterest Trends — Consumer trend predictions (80%+ accuracy)

Wikipedia Pageviews — Awareness correlation signal

Financial Intelligence:

SEC EDGAR — 20+ years of company filings

Beige Book — Fed economic insights (8x/year)

FRED — 800K+ economic time series

Seeking Alpha — Earnings transcripts

Ad Intelligence:

Meta Ad Library — All Facebook/Instagram ads

TikTok Creative Center — Top-performing ads with CTR data

Google Ads Transparency — Search/Display/YouTube ads

LinkedIn Ad Library — B2B competitive intel

VC Research:

a16z Newsletters — Sector-specific insights

Bessemer Atlas — Investment roadmaps

NFX Essays — 422+ growth essays

CB Insights Newsletter — Data-driven trends

Not Boring — Business strategy (255K subscribers)

Growth Stack (~$150-300/month)

Everything in Free Stack, plus:

Syften ($20/mo) — Real-time Reddit keyword alerts

Exploding Topics ($39/mo) — Early trend identification

SparkToro ($150/mo) — Audience intelligence

Keywords Everywhere ($15/year) — Inline search data

Crunchbase Pro ($49/mo) — Funding tracking with Scout AI

Premium Stack (~$500-1,000/month)

Everything in Growth Stack, plus:

Glimpse (~$250/mo) — Absolute search volumes with forecasting

The Diff ($20/mo) — Contrarian strategic analysis

Stratechery ($12/mo) — Platform economics expertise

BigSpy ($50/mo) — Multi-platform ad intelligence

Jungle Scout ($29/mo) — Amazon demand validation

The System, Not the List

Most trend-spotting advice gives you 50 tools and wishes you luck.

This is different. It’s an operating system:

Mine signals from upstream sources before they’re named

Validate demand across search, community, and purchase signals

Monetize through narrative, free tools, and timing advantage

The teams that run this system don’t react to trends.

They create the content, capture the keywords, and build the credibility before competition arrives.

The window is compressing. The system is your edge.

What’s the earliest signal you’ve spotted that became mainstream? Reply and tell me—I read every response.

Loved this post?

And subscribe to “Prompts Daily Newsletter” as well…

If you’re not a subscriber, here’s what you missed earlier:

The Market Entry Timing Equation: When Being Early Wins and When It Kills You

The Viral LinkedIn GTM Playbook: Frameworks That Drove Engagement and Leads

The Offer Testing Matrix: 6 B2B Hooks That Convert Cold Prospects into Pipeline

Distribution Before Product: The Operator’s 90-Day GTM Playbook - With Prompts

Subscribe to get access to the latest marketing, strategy and go-to-market techniques . Follow me on Linkedin and Twitter.

The upstream/midstream/downstream framing is super useful for thinking about signal timing. I've been using SEC filings for competitive intel but hadn't thought about cross-referencing them with subreddit growth velocity until now. The Revelio Labs reference for hiring patterns as a leading indicator is something I'm gonna dive into.