B2B Pricing Strategies - What's free to decide?

Let's discuss how to analyze customer segments, value propositions, and competitive positioning. Understand the monetization triggers, buyer behavior changes and how to build trust with users.

The last couple of weeks, I have been jamming with Himanshu on pricing strategies and how they have evolved lately. Not just small startups, but even big enterprises are now re-evaluating their b2b saas pricing models to innovate and compete in today's hyper-competitive market.

About Himanshu Mishra. He…

is a Managing Director at KPMG, USA.

has over 19 years of consulting and industry experience.

has worked across technology, media, telecommunications, and consumer industries.

has expertise in commercial transformation, including monetization (offer design, packaging, and pricing), go-to-market (strategy, execution, and enablement), and sales transformation (sales operations including lead-to-quote support, sales force enablement, channel management, etc.).

Here are the highlights of our multiple discussions, that i am going to cover below:

- Changing Buyer Preferences

- Seeing a dip in Retention and Paid Conversions? Rethink your Pricing

- Steps for deciding base value / free package

- Best Free Package Examples

For the purpose of examples and explanation, I will make a case for an “AI CRM” tool…

Changing Buyer Preferences

Buyer behavior is evolving. Today, buyers want to…

experiment first → get value → justify the price → and then decide.

Simple? Not quite.

In a B2B setting, it's even more complex. Buyers, users, and influencers (often the same person) want to:

Investigate Value Creation:

What's the effort vs. reward?

How long until they see results?

For instance, if your AI CRM claims to boost sales efficiency by 20%, they want to know how much time and resources they'll need to invest to see those results. And they want to see those results fast.

Validate Perceived Value Effectiveness:

How much better is the new option compared to the current state?

Does it meet their ideal future state?

Imagine a company currently using a traditional CRM. Your AI-driven CRM should not only promise efficiency but also deliver measurable improvements. For example, reducing manual data entry by 50% within the first month. If your solution can demonstrate a significant improvement quickly, it meets their ideal future state.

Try for

→ Bigger “Value Delta - Yours”

→ Smaller “Value Delta - Not Filled”

But how do buyers trust you?

Buyers need to feel confident in you before making a decision. Here’s what they consider:

— Who's talking about you? Are industry leaders or peers endorsing you?

— Who else is using your products or services?

— Are you consistent with your thought Leadership Initiatives?

Are you trying to build trust with your buyers? How are you ensuring they see you as a trusted partner? Think about it.

They want to compare you with at least five others. Give them reasons to choose you:

Share Success Stories, Case Studies, White Papers, and Points of View (POVs)

Highlight real-world examples where your product or service made a significant impact.

Provide detailed case studies that outline the problem, solution, and results. Include quotes and testimonials from satisfied clients.

Develop comprehensive white papers that delve into industry trends, challenges, and solutions.

Share your company's unique perspective on industry issues and future trends.

Provide them a micro-product or asset for quick win. Immediate gratification puts another layer of trust.

If you are targeting mid-market and enterprises,

Offer a Proof of Concept (POC) or pilot program with clear, measurable success metrics to track the impact.

Timing of impact also plays a key role, and if you can be explicit about what impact they should see (through clearly measurable success metrics) and by when (explicit timeframe), that just adds to your story

For instance, "Expect to see a 15% increase in lead conversion rates within the first two months.

Seeing a dip in Retention and Paid Conversions? Rethink your Pricing

If you're seeing a dip in monetizing new users and retaining existing ones, it might be time to overhaul your pricing strategy.

This requires a much more nuanced discussion, but broadly here’s how you can analyze and refine it:

1. Time to Analyze Your Positioning Matrix

Customer Segmentation and Value Prop Orientation:

What are the different customer segments? For instance, SMBs, enterprises, and startups may all have different needs and budgets.

How does your product/service offering align with the business strategy and segments? An AI CRM, for example, might provide unique benefits to each segment.

What is the best methodology to share value assets with these distinct customer segments?

What are the pricing bases that most align to customer value? Usage-based pricing, subscription models, or tiered pricing?.

What value are you offering to each segment? What unique benefits do you provide?

How does this value resonate with their current specific needs?

Competitive Positioning:

How do you stand against your competitors? Are you offering more value or better pricing?

What makes your offering unique or better and by how many percentage points? Are you 10% more efficient, 15% cheaper, or 20% faster?

2. Calculate Your Value Delta

Assess the relative value you provide compared to your competitors with this simple rule:

For any competitive benchmarking--

Example: AI CRM SaaS Company Competing with Traditional CRMs

To make this practical, let’s look at an example. Imagine an AI CRM SaaS company competing with traditional CRMs like Hubspot, Salesforce, and Pipedrive. Create a table to visualize your competitive positioning:

Create a table (like the one below) to visualize your competitive positioning:

Steps to follow while calculating your Value Delta:

List your customer segments - Identify distinct segments such as SMBs, enterprises, and startups.

Detail your value proposition for each segment. - Define what unique value each segment receives from your product.

Assess your competitive positioning. - Compare your value proposition and pricing with your competitors.

Calculate the relative value deltas from “Price-Value Comparison”

Identify areas where you can rethink your price and value proposition.

Explanation of the Table:

SMBs: Your AI-driven insights help optimize sales processes, making you more valuable (+2) compared to Hubspot. Enhance integration with other business tools to further increase your value.

Enterprises: Your scalable AI-powered CRM solutions have a higher value (+3) than Salesforce. Offering customized AI models tailored to different business needs can strengthen your position.

Startups: Your affordable and easy-to-use AI CRM scores just higher (+1) than Pipedrive. Providing free migration support and additional training can make your offering even more attractive.

Questions to ask when doing this exercise?:

Are we targeting the right segments with the right value propositions?

Does this align with our broader commercial strategy? For example, if you aim for market penetration, you might price lower initially but have clear pathways for upselling and cross-selling to expand revenue in the future.

How can we enhance our value to stand out from the competition?

What quick wins can we implement to improve our positioning?

Analyzing your pricing isn’t just about numbers.

It’s about understanding your customers, your value, and your market position.

Steps for deciding base value package

Let's say you've identified your value elements.

Now it's time to work on your packaging strategy and decide how to help customers evaluate and pay.

Here are the steps:

1. Divide Your Features and Use-Cases:

Must-Have vs. Good-to-Have:

Separate essential features from nice-to-have ones.

Critical or Important:

Determine which features are mission-critical and which are just important.

Incremental Cost to You as per Usage:

Assess the cost of providing each feature based on usage.

Efforts:

Categorize features based on the effort needed: low, medium, high.

Reward:

Identify if the reward is measurable or non-measurable.

Gratification:

Classify by gratification period: short-term, mid-term, long-term.

Utility:

Determine how often the feature is used: daily, weekly, monthly.

Trigger / Itch:

Rate the feature’s ability to trigger user action: low, medium, high.

2. Based on These Categories, Create Your Base Package to create value:

Free Tier / Free Trial / Freemium:

Include critical features, important use-cases, low-cost, low-to-medium efforts, measurable rewards, short-to-mid-term gratification, and medium-to-high trigger.

2.1 Free Tier:

When to Choose:

To quickly grow your user base.

When you have a strong upsell strategy.

Pros:

Fast user acquisition.

Increased brand exposure.

Cons:

Minimal direct revenue.

High support costs.

2.2 Free Trial:

When to Choose:

When your product shows clear value quickly.

For short sales cycles aiming for quick conversions.

Pros:

High conversion potential.

No long-term commitment for users.

Cons:

Users may not convert post-trial.

Managing trials can be resource-intensive.

2.3 Freemium:

When to Choose:

When your product has valuable free and premium features.

To balance a large user base with steady premium upgrades.

Pros:

Fast user acquisition.

Increased brand exposure.

Cons:

Free version may feel too limited

Requires careful feature management.

Questions to Consider:

Which features are absolutely essential for your users?

How can you provide immediate value to encourage upgrades?

What balance of free and premium features will attract and retain users?

Best Free Package Examples

Effective free packages can bring users back to your product repeatedly, eventually justifying a purchase. Let's see how some successful companies have done this.

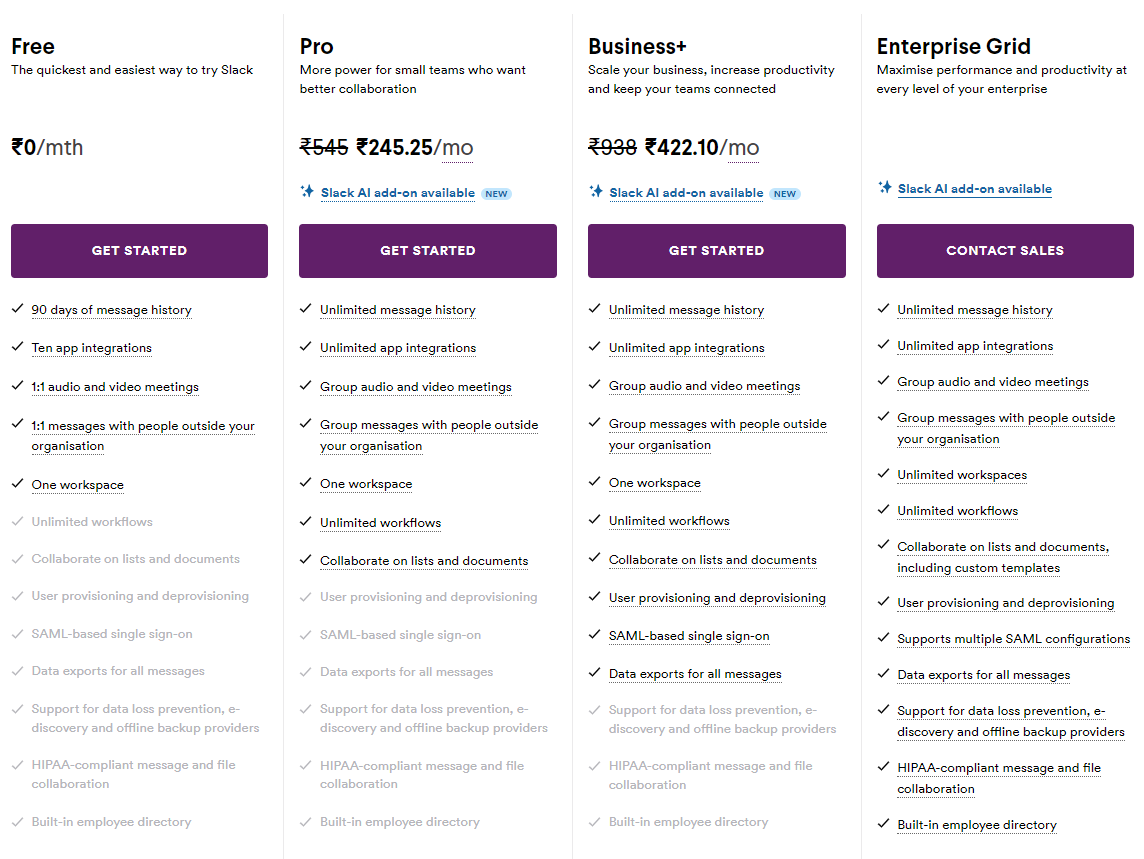

1. Free Tier - Slack:

Strategy:

Slack offered a free tier with limited message history and integrations to attract small teams and startups.

Outcome:

Rapid user growth and adoption among small businesses.

Many free users eventually upgraded to paid plans as their teams grew and needed more features.

What if they had chosen another tier?

Offering a free trial might have resulted in

quicker conversions

but less initial user base growth.

Limited adoption as a product has a very high mid-long term gratification.

2. Free Tier - HubSpot:

Strategy:

HubSpot provided a free CRM to attract businesses. They offer additional marketing and sales tools at premium levels.

Outcome:

Significant increase in user base and lead generation.

Many mid-size companies started with the free CRM and later upgraded to comprehensive marketing and sales solutions.

What if they had chosen another tier?

A free-trial model could have

limited adoption as a product has a very high mid-long term gratification.

3. Free Trial - ConvertKit:

Strategy:

ConvertKit offered a 14-day free trial of its email marketing software, allowing users to experience full features and value creation within 14 days.

Outcome:

High conversion rates from trial to paid users.

Significant revenue growth and user loyalty.

What if they had chosen another tier?

A free tier might have increased the user base but reduced the urgency to convert to paid plans quickly.

And short term value creation is immense in free trial which creates a positive perception - “Take it or Leave it”

4. Free Trial - Salesforce:

Strategy:

Salesforce provided a 30-day free trial of its CRM, enabling businesses to explore the platform's capabilities.

Outcome:

Increased conversions and customer acquisition.

Many mid-size businesses opted for Salesforce after experiencing its impact on their sales processes during the trial.

What if they had chosen another tier?

A freemium model could have led to

wider initial adoption

but slower premium conversion rates.

Non ICPs (early stage startups, frugal companies) to sign up

5. Freemium - Trello:

Strategy:

Trello offered a freemium model with basic boards and lists for free, while charging for advanced features like integrations and power-ups.

Outcome:

Massive user adoption with many small businesses and teams.

A significant portion of users upgraded to premium plans for enhanced functionalities.

What if they had chosen another tier?

A free trial

might have provided quicker revenue

but reduced long-term user engagement and adoption

Since the product has mid-long term value creation which increases with usage, it has to be “Freemium”

A free tier

Could limit the experience of features as each feature is valuable and scalable and can trigger premium subscription.

6. Freemium - Dropbox:

Strategy:

Dropbox provided a freemium model with limited free storage and charged for additional space and advanced features.

Outcome:

Widespread adoption among individuals and businesses.

Many mid-size companies upgraded to premium plans to accommodate their growing storage needs and collaboration tools.

What if they had chosen another tier?

A free trial could have

led to faster revenue

but less initial user base growth and brand exposure.

Also, not everyone would want to upload and collaborate on files if it’s limited to a time period. Value creation is immense in mid-term and data stickiness.

Questions to Consider:

- Which free package tier aligns best with your product and user base?

- How can you balance user acquisition with revenue growth?

Loved this post?

Free tools that you can try:

ContentGT

Harness the power of AI to produce SEO-optimized, audience-tailored content effortlessly. 10 Articles free per month.

Twice as Nice

A free collection of landing page copy templates for your product

Featured Posts

My journey as a Solopreneur

Planning a GTM Motion and Strategies

If you’re not a subscriber, here’s what you missed earlier:

Subscribe to get access to the latest marketing, strategy and go-to-market techniques . Follow me on Linkedin and Twitter.