Scaling with Partner-led Growth: A CMO’s Blueprint

Could partnering with other companies and professionals be the new growth strategy? Explore how CMOs could fast-track reaching new markets and boosting sales through partner-led growth.

👋 Hey, Ayush here! Welcome to this week’s ✨ free edition ✨ of Startup GTM Newsletter.

I have been building startups for the last 7 years and working with founders on GTM, growth, people-first strategies, communities and anything else about building a startup.

If you’re not a subscriber, here’s what you missed earlier:

Subscribe to get access to these posts, and every post. Follow me on Linkedin and Twitter. Want to discuss about collaboration or GTM? Setup a meeting on this link

Some of the stats on real ROI…

As per Canalys, App marketplaces are growing at a rate of 84% YoY, marking the fastest-growing channel in SaaS. They are projected to generate $45 billion in revenue by 2025.

As per State of Partner-led Growth 2023 report by Hubspot,

39% of marketing leaders report 1-10% of new leads emanate from partners, and partner leads are perceived 26% to 50% more likely to close.

93% of sales leaders report reps collaborating with partners to close deals, with partner-attached deals seen as 26-50% more likely to be won

Curious about Partner-led Growth? Let’s dive into the following areas…

Partner-led Growth Evolution

Market trends - Is it actually impactful?

Case Studies - Bynder and SugarCRM

How does it fits into Sales and Marketing Cycle?

Potential Pitfalls

Partner Collaboration in Sales Process

Evolution

In the Software as a Service (SaaS) industry, the narrative of growth has been significantly rewritten by the strategic lever of partnerships, evolving from peripheral channels to central core strategies in the go-to-market planning.

Partnership Reliance:

Couple of decades ago, the partnership paradigm was still nascent, yet the idea of collaborative growth started resonating with businesses but was limited to large scale companies building strategic partnerships with Resellers and System Integrators like Accenture, Deloitte etc. The focus, especially those in the SaaS sector, and not just the high growth companies, has shifted from in-house growth efforts or just reseller and system integrators to exploring synergies with other market players for Co-selling and Co-promoting opportunities too.

Data-Driven Validation:

As the partnership model started showing promise, data began to validate its efficacy. Insight Partners' data spotlighted that 64% of SaaS scale-ups leaned on partnerships, which contributed to 12% of the new business pipeline across all revenue stages, creating a strong case for partnership narrative.

From Channels to Strategic Allies:

Partnerships have become more than just traditional "channels.", taking on a more active, end-to-end role across the product lifecycle, influencing not just sales, but tech strategy, design, vendor selection, migration, adoption, and management.

Value-Added Resellers (VARs) Emergence:

The rise of Value-Added Resellers (VARs), with their domain or industry-specific focus, enhanced the value proposition of SaaS offerings. This narrative is strongly supported by the fact that over 30% of the revenues of giants like Atlassian and HubSpot are attributed to such partnerships.

Macro-economic Projections and Integrated Partner Networks:

Based on McKinsey's macroeconomic forecasts, it's estimated that by 2030, a third of the global economy, which is roughly $100 trillion, will function through interconnected partner networks.

App Marketplaces and GTM Strategy Evolution:

The emergence and rapid growth of app marketplaces are significantly influencing Go-To-Market (GTM) strategies in the SaaS landscape. Propelled by major hyperscalers and SaaS vendors, these marketplaces have become a thriving channel for third-party app sales, bolstering the GTM strategies of many SaaS companies. With robust growth metrics and substantial revenue projections, app marketplaces are going to be an important vertical in partner-led growth.

As per Canalys, App marketplaces are growing at a rate of 84% YoY, marking the fastest-growing channel in SaaS. They are projected to generate $45 billion in revenue by 2025.

Hyperscalers like Amazon Web Services (AWS), Google, and Microsoft, or big SaaS vendors like Salesforce and Atlassian are at the core of these marketplaces, opening their platforms to third-party apps.

Revenue Generation

AWS alone facilitates over $1 billion per year via its marketplace.

Microsoft recently celebrated closing $100 million in deals via their marketplace in a single week.

Example

CrowdStrike is transitioning to a marketplace-first GTM strategy following a 100% YoY growth on AWS.

Commission Rates

Commission rates range from a low of 3% (Microsoft, Google, AWS) to a high of 25-30% (Atlassian and others).

FinTech Partnership Trends:

Banks and financial institutions are increasingly leaning on FinTech partnerships to bolster their strategies and harness digital advantages. Key trends from a recent EY-Parthenon survey include:

Increasing Reliance on Partnerships: Presently, 32% of banks deem these alliances crucial, with projections indicating a rise to 55% by 2025.

Primary Objectives of Partnering:

95% aim to enhance their digital products and reach.

87% seek to manage critical processes.

86% strive to cut costs and accelerate implementation times.

Concerns and Challenges:

High failure rates with 40% estimating a 20-40% failure rate and 33% believing failure rates could exceed 40%.

78% find it challenging to formulate an internal framework for managing partnerships.

75% struggle to understand how a partnership aligns with their strategic and commercial goals.

64% face difficulty in identifying and prioritizing the right partners.

53% find onboarding new partners difficult, citing old systems and insufficient support as major hurdles, prolonging the process between 7 to 18 months.

Market trends - Is it actually impactful?

The "State of Partner-led Growth 2023" by HubSpot sheds light on the pivotal role partnerships play in the SaaS sales and marketing landscape. The insights underscore a resounding acceptance for partnerships among sales and marketing leaders. Following are some of the take-aways…

Endorsement for Partnerships

98% of sales leaders and 95.9% of marketing leaders advocate for organizational investments in partnerships.

42% of these leaders are willing to allocate 10-25% of their budget towards partnerships.

Effectiveness & Impact

93% of leaders primarily focused on partnerships find them increasingly effective in reaching target audiences.

Over 57% of sales leaders and 40% of marketing leaders observe partners' impact across the entire revenue funnel.

Lead Generation & Closure

39% of marketing leaders report 1-10% of new leads emanate from partners, and partner leads are perceived 26% to 50% more likely to close.

Utilization of Partner Data

64% of marketing leaders utilize partner data in campaigns, with a mixed response on its impact on campaign performance.

73% of sales leaders use partner data in prospecting, finding it more accurate than third-party data.

Sales Collaboration

93% of sales leaders report reps collaborating with partners to close deals, with partner-attached deals seen as 26-50% more likely to be won.

Alignment with Partnerships

Between 45% and 49% of leaders report a strong alignment between marketing or sales and partnerships in their organizations.

Case Studies of Partner-led Growth

Bynder - Redefining Integration Positioning for Growth

Bynder is a digital asset management (DAM) provider, offering a centralized platform for managing and distributing digital content. The platform acts as a unified source for digital assets, ensuring value optimization and brand consistency.

As per an interview with Tony Aquino (Group Product Manager, Bynder), Bynder enhanced its tech partner program in 2020, expanding its tech ecosystem from 13 to 26 integrations in just six months.

Challenges

- Tech and SI partners provided limited post-launch support for custom integrations.

- The sales team struggled with the complexity of integrations, often discussing them only after sales were made.

- Developers were building integrations that didn't fully meet customer needs, with minimal quality assurance post-launch.

Actions to Overcome Challenges

1. Extended Partner Engagement:

Shifted to ongoing support and engagement in GTM activities with tech and SI partners like co-marketing and co-selling.

Introduced a three-tier system for tech partners: Strategic, Marketplace, and Growth.

2. Simplification of Integration Processes:

Created a simplified repository of three integration types for the sales team to point prospects to the right internal stakeholders to discuss development and adoption prior to closing the deal.

Classified 20+ integrations into Upstream, Downstream, and Bidirectional.

3. Optimising Integration Development:

Bynder initiated integrations with major SaaS platforms, such as Salesforce, SAP, and Adobe, often called Supernodes due to their extensive partner networks. Given the high customization demands of these systems for clients, Bynder's integration team faced the need for additional resources and expertise.

To address this, instead of hiring specialized developers for each Supernode, Bynder chose to collaborate with subject matter experts (SMEs) via their system integrator (SI) partners.

Key Steps and Impact

Action #1 - Implementation of Three-Tier Partner Structure

- Bynder introduced a three-tier system for tech partners: Strategic, Marketplace, and Growth.

- Strategic partners engage in long-term collaborations, primarily with SI partners.

- Marketplace partners are involved in integration listings but do not participate in GTM activities.

- Growth partners are Marketplace partners who gain extra benefits like strategic account mapping with Crossbeam, as well as co-marketing and co-selling opportunities.

Key Steps

- Bynder established specific guidelines and benchmarks for the timeline of integration launches, encompassing the building, launching, and GTM activities with tech partners.

- Post-integration launch, Bynder maintains prolonged relationships with tech partners, incorporating them in joint selling initiatives with their SI partners.

- The company ensures tech partners adhere to set timelines and quality standards for integration development. Bynder also delineates integration lifecycle phases to track each integration’s progress, enhancing visibility for GTM teams.

- Incentives for partners include real-time account mapping via Crossbeam, collaborative selling with SI partners, and joint marketing ventures.

- Growth partners are offered opportunities for ongoing co-selling collaborations with SI partners, enhancing mutual customer base outreach.

Impact

- Enhanced visibility with tech partners aids Bynder's sales team in more accurately informing prospects about upcoming integrations.

- This collaborative model encourages partners to participate actively in GTM activities and co-selling, especially those in the Growth tier, fostering upward mobility within the partnership.

- Bynder’s approach incentivizes tech and SI partners to consistently provide quality assurance and maintain integrations, thereby accessing ecosystem qualified leads (EQLs) and adding value for their customers.

Action #2 - Simplification of Integration Types

Key Steps

- Bynder reclassified its integrations into three types: Upstream, Downstream, and Bidirectional.

- This reclassification is part of Bynder's narrative about contributing to a “connected ecosystem” for clients.

Impact

- This change led to an increase in the partner attach rate for closed-won opportunities and a rise in the average selling price for deals influenced by tech partners.

- Sales representatives can now quickly identify the type of integration a prospect needs, streamlining the decision-making process and improving post-sales satisfaction and retention.

Action #3 - Collaboration with SMEs for Advanced Integrations

Key Steps

- Bynder began working with SMEs to integrate with major platforms, like Salesforce.

- The partnership with Salesforce led to the introduction of the Digital Asset Transformation (DAT) feature, expanding Bynder’s offerings beyond traditional DAM.

Impact

- This move allowed Bynder to venture into content delivery in addition to DAM, reaching a new segment of large enterprise customers.

- There’s improved alignment between Bynder’s partnership and product teams, fostering a collaborative approach to feature development and integration planning. This approach often results in the creation of features with open APIs to support future integration possibilities.

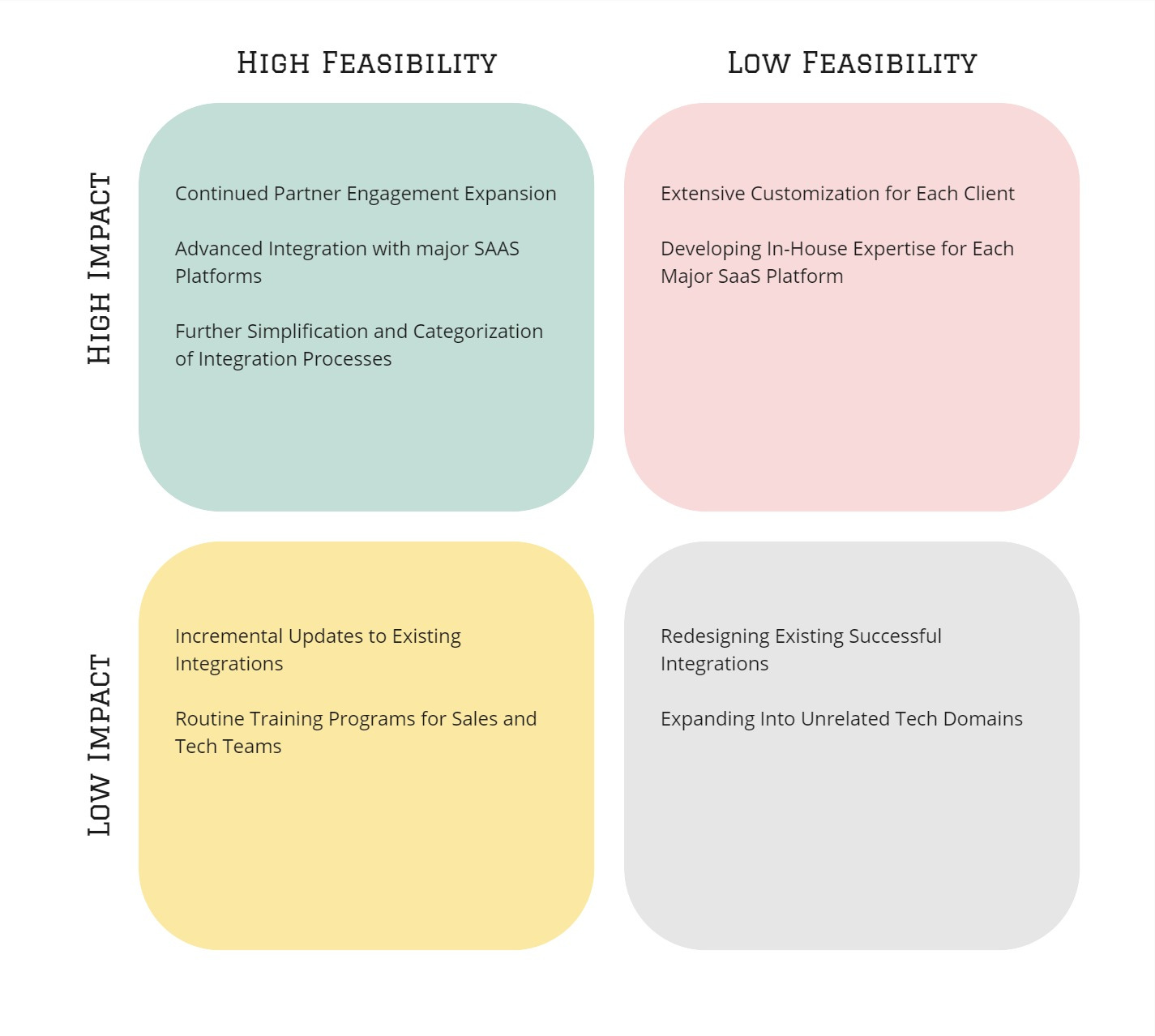

Takeaways

SugarCRM and Redington Gulf - Middle-East expansion through Partnerships

SugarCRM, a Silicon Valley-based enterprise, offers an AI-enhanced customer relationship management (CRM) platform. This platform is designed to improve interactions between businesses and their customers, fostering better communication.

Challenges

Initially, SugarCRM's main strategy was direct sales, with limited presence in the Middle East. The company aimed to penetrate and expand in this region, recognizing the potential for growth.

Strategies to Address Challenges

- SugarCRM identified Redington Gulf as a key potential partner for expansion in the Middle East.

- Redington Gulf's credentials were impressive: it's a division of Redington and the largest IT product distributor in the Middle East and Africa. It boasts a network of 34,000 resellers, over 70 sales offices globally, and more than 15,000 customers in the Middle East. The company excels in providing technology training and facilitating joint engagements, following a channel-focused business model.

Key Steps and Resulting Impact

- Partnership Initiation: SugarCRM launched a partnership program with Redington Gulf to use their extensive reseller network and sales offices for distributing SugarCRM solutions in the Middle East.

- Reseller Agreement: Redington Gulf became a distributor for SugarCRM’s comprehensive solution range, including sales, marketing, and customer service tools, available both in cloud and on-premises formats, tailored to the Middle Eastern market.

Impact

- In 2022, SugarCRM observed a remarkable 59% year-over-year growth in new customers. This surge was partly attributed to its global expansion via channel partnerships, particularly with Redington Gulf.

- The collaboration allowed SugarCRM to introduce both cloud-based and on-premises CRM solutions in the Middle East, gaining an edge over competitors who only offered cloud solutions.

How do partnership types fit into the Sales and Marketing Cycle?

The right partnership helps guide the business to profitable opportunities and gives extra strength to compete. The connection between different partnerships and the sales and marketing cycle creates a plan, helping the business navigate through market challenges. Each type of partnership adds a unique touch to the sales and marketing efforts, boosting reach, engagement, and conversions.

Influencer Partnerships

Amplify brand visibility through trusted voices, thus nurturing leads down the sales funnel with a touch of credibility.

Metrics: Audience Reach, Engagement Rate, Lead Quality.

Impact: Enhanced brand trust, lead generation.

Example: Dropbox engaging influencers to create content around their brand, expanding their reach.

Channel Partnerships

Act as extended sales arms, reaching markets far and wide, and accelerating the journey from lead generation to deal closure.

Metrics: Market Share, Sales Volume, Customer Acquisition Cost (CAC).

Impact: Extended market reach, revenue augmentation.

Example: Microsoft’s extensive network of channel partners selling its software solutions.

Marketing Partnerships

Pool resources to co-create marketing campaigns, mutually amplifying brand awareness and lead generation.

Metrics: Lead Volume, Conversion Rate, Return on Marketing Investment (ROMI).

Impact: Augmented brand visibility, lead pool expansion.

Example: Spotify and Starbucks’ joint campaigns promoting each other’s brands.

Example: Atlassian and Slack’s co-marketing campaigns post partnership agreement

Sales Partnerships

Embark on joint sales ventures, sharing insights and leads, thereby boosting the conversion rate with a combined sales strategy.

Metrics: Conversion Rate, Sales Cycle Length, Customer Lifetime Value (CLV).

Impact: Elevated conversion rates, shortened sales cycles.

Example: Sales partnerships between software vendors and consulting firms for solution selling like Hubspot and Salesforce.

Strategic Partnerships

Foster long-term market growth by aligning strategic goals, sharing market insights, and co-innovating solutions to meet evolving market demands.

Metrics: Market Penetration Rate, Customer Retention Rate.

Impact: Long-term market growth, customer satisfaction.

Example: Apple and IBM’s collaboration on mobile enterprise applications.

Referral Partnerships

Drive warm leads through trusted referrals, shortening the sales cycle and enhancing the conversion rate.

Metrics: Referral Rate, Conversion Rate.

Impact: Quality lead generation, enhanced conversion rates.

Example: Slack’s referral program to attract new customers.

Reseller Partnerships

Augment market access and revenue generation by leveraging partners' sales channels, while also gathering market feedback to refine the product offerings.

Metrics: Sales Volume, Revenue Growth.

Impact: Expanded market access, increased sales.

Example: Shopify’s reseller program expanding its market presence.

When properly integrated into the sales and marketing cycle, each partnership opens up a range of opportunities, driving the venture towards growth and collaborative success.

Potential Pitfalls in Partner-led Growth

Planning Tax - Despite their potential to outperform direct marketing campaigns in terms of engagement and conversion rates, co-marketing campaigns often entail a higher customer acquisition cost. The additional coordination effort required across multiple companies, termed as a "planning tax" by John Miller, CMO of Demandbase, underpins this drawback.

Partner Concentration - Relying too heavily on a single channel partner for a substantial portion of revenue can spark concerns regarding a company's control over its distribution destiny. A fallout or renegotiation of terms with such a partner could significantly jeopardize revenue and future growth.

Margin Impact - The financial feasibility of partnerships has always been a focal point for concern. For instance, a channel partnership with comparable support costs but a 25% revenue share may be less profitable than direct sales, prompting a re-evaluation of the partnership rationale.

Channel Conflicts - The potential of a channel partner turning into a competitor is a plausible risk. For instance, the acquisition of Motorola Mobility by Google raised eyebrows among other smartphone manufacturers using the Android OS. Similarly, Apple's venture into headphone manufacturing after reselling Bose headphones showcased a shift from partnership to competition.

Operational Coordination - The "planning tax" extends beyond co-marketing campaigns to broader coordination with partners, demanding significant time and energy. This is especially challenging when both entities have pre-planned campaigns, necessitating a strategic alignment of priorities for successful joint activities.

Alignment Challenges - Bridging the alignment between partner marketing and business development teams is often a slippery slope, more so when these teams have divergent metrics and goals, making seamless collaboration a tough nut to crack.

Partner Collaboration in Sales Process

As per Hubspot report, “The State of Partner-led Growth”, the partner collaboration process is divided into 5 stages and 2 verticals. Stages are segregated as Pre-Sales and Sales Process Stages, while verticals are segregated as the “Commercial Focus Activities” and “Operational Focus Activities”. Building and Planning on Collaboration Process requires operating across all 5 stages and both the verticals to ensure the success of partnership.

Stage 0

Ambition Setting (SaaS & Partner)

Align on sales target (clients etc) and follow-up on commercial progress - Marketing Leads

Commercial Focus

Prospect qualification and basic discovery call (Partner)

Identify prospect and conduct exploratory call - Obtains answer to important questions

Stage 1

Lead Qualification and deep need discovery (SaaS & Partner)

Provide basic qualifying into the prospect

Conduct discovery call to clarify client need and usecase

Understand buying criteria / process

Stage 2

Evaluation and Demos (SaaS & Partner)

Validate data availability, demo specifically to prospect needs

Stage 3

Proposal (SaaS & Partner)

Present proposal, ROI analysis, and follow-up demos

Stage 4

Agreement / Negotiation (SaaS & Partner)

Finalise scope, timeline, budget, and legal contract

Operational Focus

Setup data integration (SaaS & Partner)

Setup

Data Integration

Map activities to activities

Decision Making Tools (SaaS & Partner)

KAM - Upselling, Cross Selling Support (SaaS & Partner)

Nurture client relationship with regular check-ins, especially to identify upsell opportunities

Conclusion

Marketers are always on the hunt for innovative strategies. First, it was about creating content, then it shifted to Account-Based Marketing (ABM). Now, if partner marketing becomes the next big thing in the marketing community, it could really take off and become a central strategy.

Moreover, if your target buyers are big companies who prefer buying through a partner or a marketplace, it's time to forge strong relations in the marketplace and set the terms right. This way, you're not just following the trend, but making smart moves that align with where your buyers are and how they prefer to make purchases.

Want to discuss collaboration or go-to-market strategy?

Subscribe to our newsletter for exclusive insights, tips, and expert advice.

Plus, schedule a 1:1 Brainstorming Meeting with Ayush through Calendly link!